Condo Insurance in and around Sumner

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Calling All Condo Unitowners!

As with anything in life, it is a good idea to expect the unexpected and try to prepare accordingly. When owning a condo, the unexpected could look like damage to your unit and personal property inside from vandalism fire, wind, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Why Condo Owners In Sumner Choose State Farm

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance covers more than your condo. It protects both your condo and your precious belongings. In case of falling trees or vandalism, you could have damage to some of your belongings in addition to damage to the townhouse itself. Without insurance to cover your possessions, you may struggle to replace all of the things you lost. Some of your valuables can be protected from theft or loss even if you take them outside of your condo. If your bicycle is stolen from work, a condo insurance policy could cover the cost.

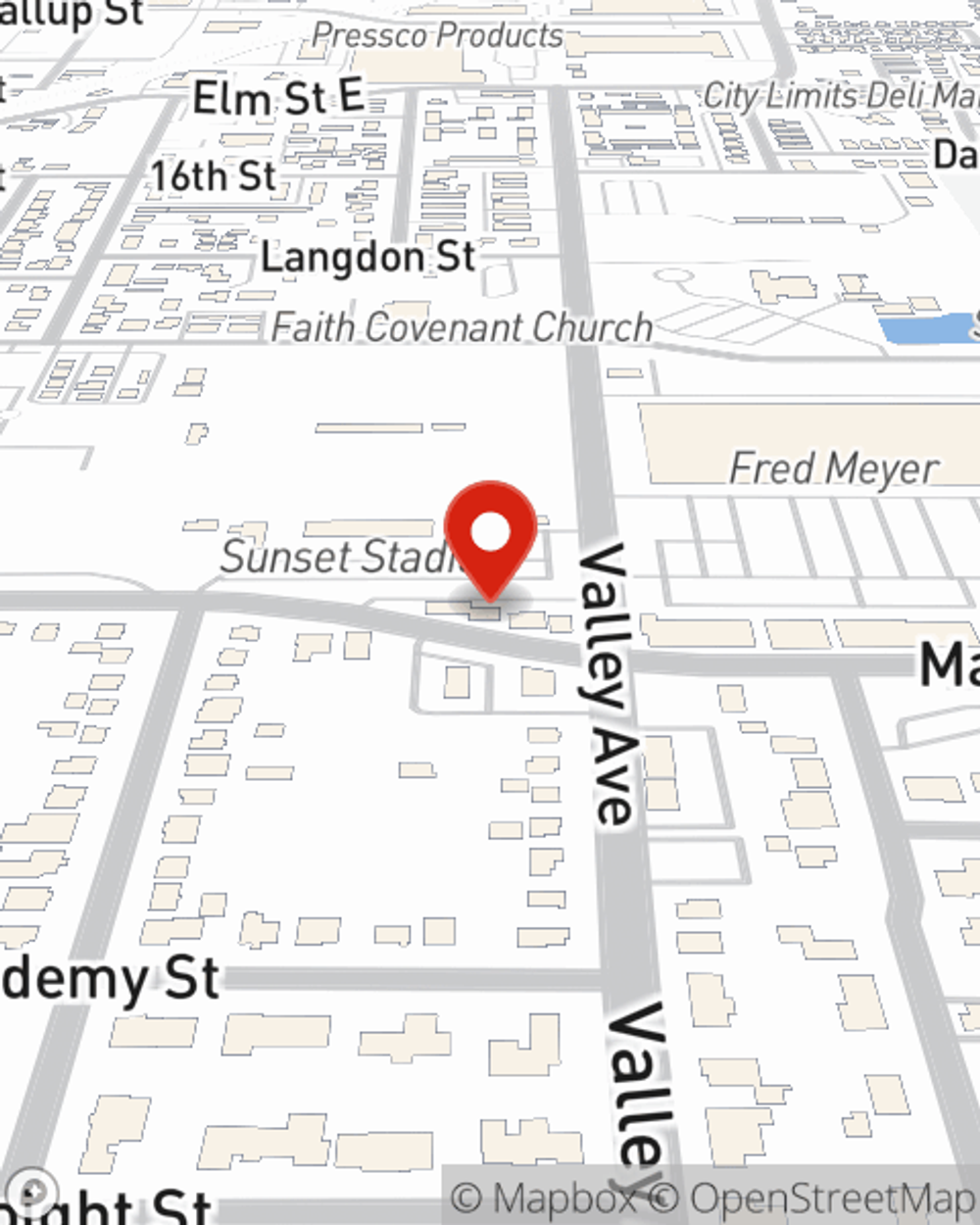

As one of the top providers of condo unitowners insurance, State Farm has you covered. Contact agent Dan McClung today for help getting started.

Have More Questions About Condo Unitowners Insurance?

Call Dan at (253) 863-7927 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Dan McClung

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.